Introduction

As climate goals and policymakers emphasize the need to invest in green technologies, demand for additional mineral inputs is growing—particularly rare earth minerals—to drive this growth and meet climate targets. Beyond their critical role in supporting renewable-energy technologies, rare earth minerals are used in modern smartphones, televisions, computers, light-emitting diode (LED) lighting, and defense systems. The current key challenge lies in determining whether there is a sufficient and secure supply of rare earth minerals to underpin this energy transition.

The world is undergoing an energy transition as it seeks to reduce reliance on fossil fuels. This shift creates new demands and supply-chain dependencies for various natural resources—resources that are relatively unfamiliar to everyday consumers.

Background

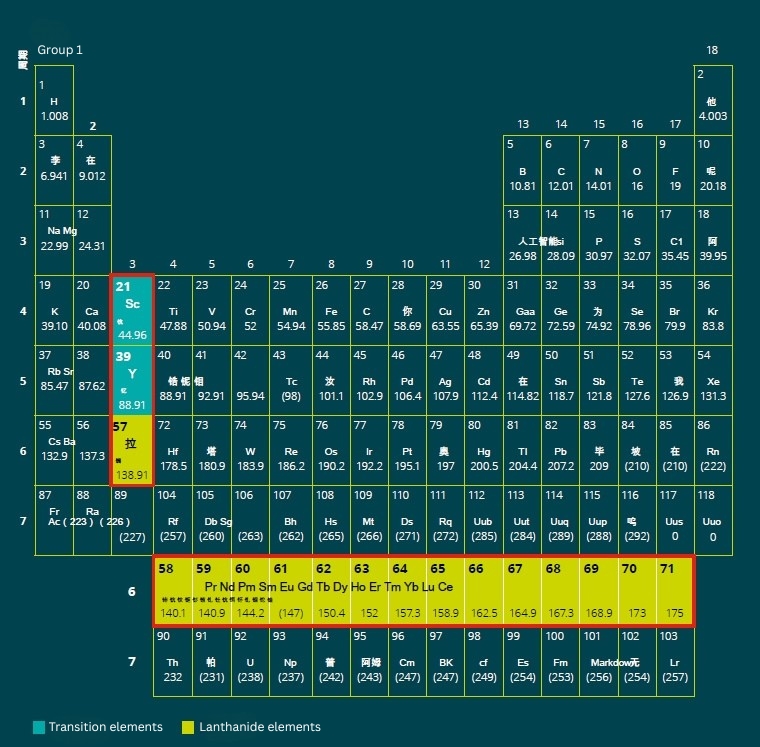

Rare earth minerals (REM) are composed of 17 rare earth elements (REE) with similar chemical properties. These elements are divided into two categories: light rare earth elements (LREE) and heavy rare earth elements (HREE).

Rare Earth Applications

Rare earths have unique properties due to their magnetic, luminescent, and electrochemical properties, making them essential in a variety of high-tech applications, including:

Historical

The term “rare earths” (RE) originated in the late 18th and early 19th centuries when these elements were first discovered centuries ago. Despite the name, they are neither rare nor rare earth elements. However, at the time, they were challenging to separate and were only found in relatively rare deposits. In fact, rare earth elements are relatively abundant in the earth’s crust, but they are rarely found in a concentrated and economically valuable form compared to ores of other metals.

How Do Rare Earth Elements Impact the Energy Transition?

The overarching goal of the Paris Agreement is to limit the rise in global average temperature to no more than 2 °C above pre-industrial levels, while pursuing efforts to cap warming at 1.5 °C.¹⁶

However, experts increasingly believe that meeting these targets will be extremely challenging. To achieve them, nations must accelerate deployment of renewable-energy technologies—such as wind turbines, solar photovoltaic panels, electric vehicles (EVs), and energy-storage systems. These technologies offer clear advantages in system efficiency and power quality, but their large-scale commercialization still faces significant technical and economic hurdles.

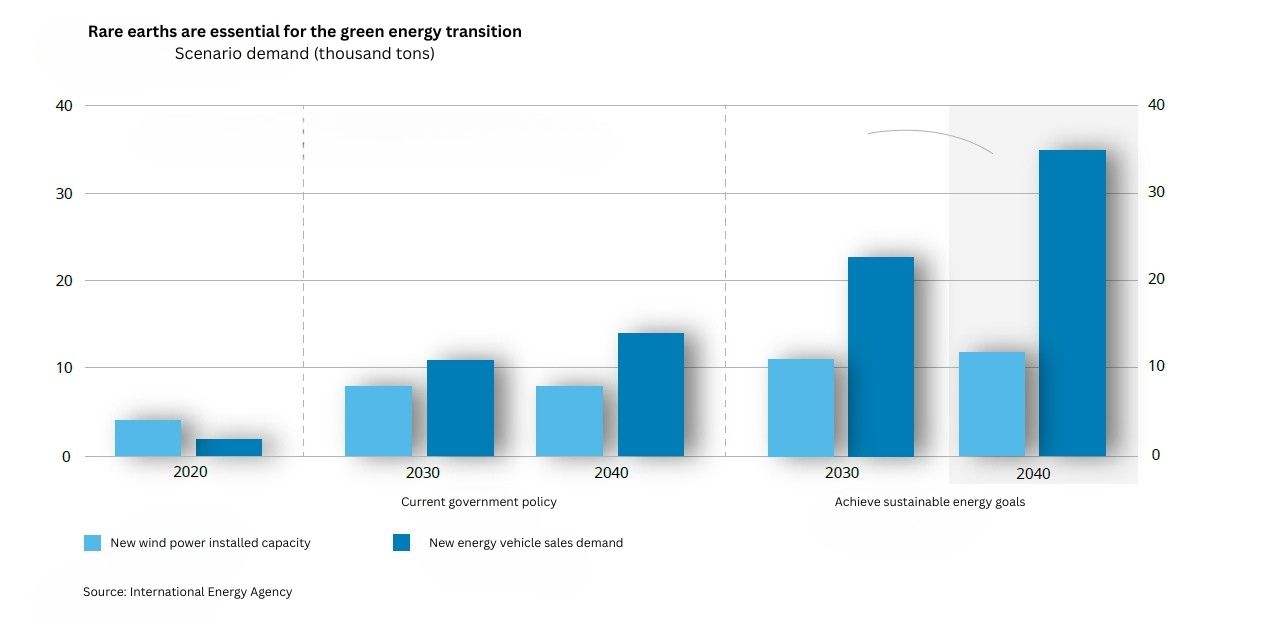

Rare earth elements are critical to enhancing the performance, size, and weight of electric vehicles. They play a central role in the manufacture of motors and generators: compared with conventional magnets, rare-earth-based permanent-magnet materials exhibit higher magnetic energy density and more reliable performance. This makes rare earths one of the key enabling foundations for driving the green revolution and realizing zero-emission goals.

Global Demand and Supply Trends

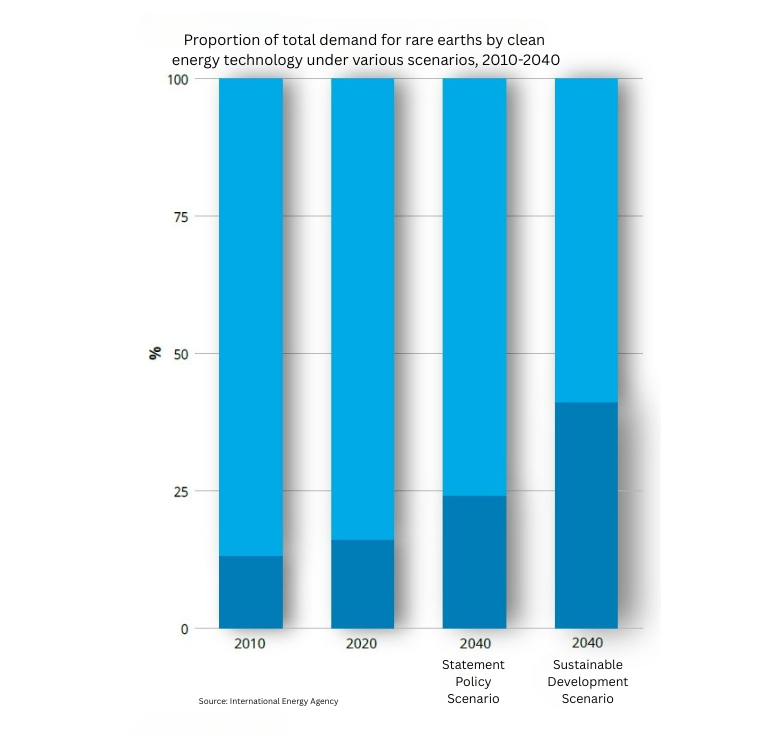

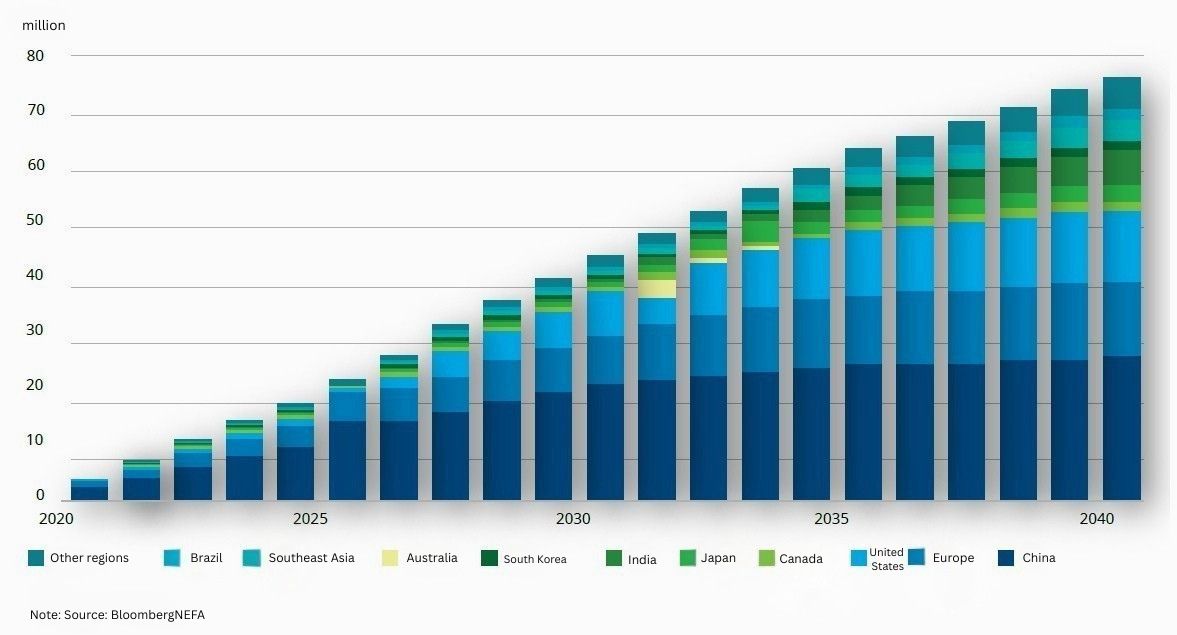

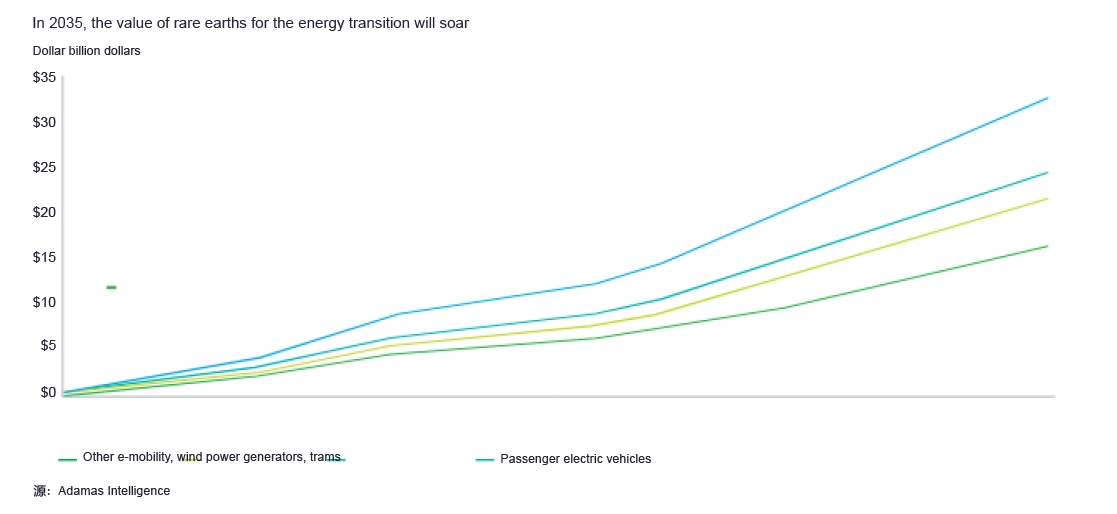

The shift to clean energy is a key driver of rare earth demand, which is expected to increase by 300-700% by 2040. The share of clean energy in total rare earth demand is also expected to rise from 13% in 2010 to 41% in 2040.

Clean energy technologies require significantly higher rare earth inputs than traditional hydrocarbon systems. For example, electric vehicles require six times as many minerals (including rare earths) as internal combustion engine vehicles, while onshore wind farms require nine times as many mineral resources as gas-fired power plants. In 2023, approximately 18% of global car sales were electric, and this share is expected to rise to 73% by 2040. Similarly, global wind capacity increased from 904 GW in 2022 to 1,021 GW in 2023 (both onshore and offshore), an increase of 13% in one year. This growth relies heavily on rare earths such as neodymium, praseodymium,

China is leading the way in global clean energy adoption, accounting for about 60% of global EV sales in 2023. By August 2024, China announced that its wind and photovoltaic capacity target had been completed six years ahead of schedule, exceeding 1,200 GW. However, as of now, solar and wind energy account for only 14% of the country’s electricity generation. Therefore, significant investments will be required in the future to meet the renewable energy targets that rely on rare earths.

Under the BNEF economic transformation scenario, global long-term passenger car EVs are sold by market

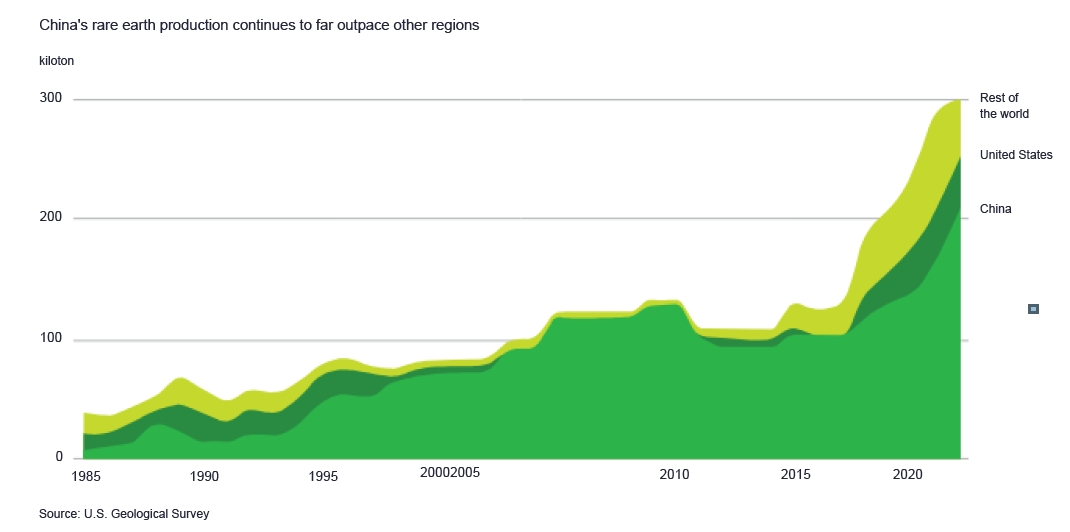

The supply of rare earths is much more concentrated than that of the oil and gas industry, with China supplying 60% of the global market. Mining is only the first step, and rare earth processing involves a highly specialized, multi-stage process (separation, refining, and forging) in which China has established a dominant competitive advantage, responsible for 90% of the world’s processing operations. China’s power has expanded further, as the country has also been investing in overseas assets, including the United States, Australia, and Chile, increasing its geopolitical influence, which increases the risk of potential trade restrictions and supply disruptions.

Geographical Distribution

In terms of production, China is also the largest producer of rare earths, reaching 240,000 tonnes in 2023, with the United States producing 43,000 tonnes, Myanmar producing 38,000 tonnes and Australia producing 18,000 tonnes.

The industry faces other problems, such as long project cycles. If investment in new projects is delayed until there is a deficit, it can lead to tight markets and price instability, raising questions about increasing renewable energy production capacity. Resource quality is another important issue, as mining low-grade ore in more difficult locations may require more energy, which will further increase production costs and environmental impact.

The development of EESM technology by companies such as Renault and Vitesco Technologies is driving performance improvements, an option that offers potential supply chain security and sustainability, as well as cost and energy savings compared to the more common permanent magnet synchronous motor (PMSM). The total estimated global reserves of rare earths are 11 million tonnes, mainly in China, which has 4.4 million tonnes (mainly found in the Baiyun Obo mine). Other countries with significant reserves are Vietnam (2.2 million tonnes), Russia (2.1 million tonnes) and Brazil (1 million tonnes). The United States has 1.8 million tons

The European Union, for example, is negligible in terms of mining and processing capacity, and the region is a world leader in the development of wind turbines and electric vehicles. However, they rely on critical components from China. The U.S. reopened its only rare earth mine (the Mount Pass mine) in 2018, which was since acquired from bankruptcy (caused by competition from Chinese suppliers) by a consortium that includes Chinese-owned companies. All rare earths are sent to China for processing; However, the U.S. is working to reactivate a separation plant to process rare earths domestically.

The industry faces other problems, such as long project cycles. If investment in new projects is delayed until there is a deficit, it can lead to tight markets and price instability, raising questions about increasing renewable energy production capacity. Resource quality is another important issue, as mining low-grade ore in more difficult locations may require more energy, which will further increase production costs and environmental impact.

As a result of these variables, a growing number of automakers and suppliers are developing EVs that are free of rare earths or less dependent on rare earths, such as Tesla – the world’s largest EV manufacturer in 2023 – plans to reduce heavy rare earths by 25% per vehicle and aims to rid its next-generation EV models of rare earths. A key technological advance to support this transition is the use of externally excited synchronous motors (EESMs), which, unlike conventional motors, generate a magnetic field through an electric current and therefore do not rely on permanent magnets made of rare

The development of EESM technology by companies such as Renault and Vitesco Technologies is driving performance improvements, an option that offers potential supply chain security and sustainability, as well as cost and energy savings compared to the more common permanent magnet synchronous motor (PMSM)

There are technology trade-offs across many industries, however, the trajectory of non-renewable-dependent technologies raises larger questions about whether the expected demand can be met, and how this will affect the viability of future investments.

The European Union and the USA have launched investigations into potential alternative supply options. The United Nations Economic Commission for Europe (UNECE) reported in 2022 that Sweden has significant rare earth reserves and its supply capacity is sufficient to meet Europe’s demand for forecasted rare earth elements (HREE) for more than 20 years. Southern and Eastern Europe also show rare earth mining potential and can be

Ultimately, the direction of demand depends on technological advancements and policy development. This uncertainty is driven by climate policy and how strictly governments and international institutions will enforce the law. Policymakers have a vital role to play in reducing this uncertainty by clarifying their goals and translating them into action. This will be key to building trust and investment and opening up financial flows for green technologies

Security of supply

Dependence on China has led countries to diversify their supplies, although little progress has been made in this area. Due to China’s dominance in the supply and processing of rare earths, the most effective strategy to reduce dependence is to look for technological solutions away from the rare earths that manufacturers are pursuing, however, as mentioned earlier, the proliferation of alternative technologies to reduce rare earths is still in the development stage.

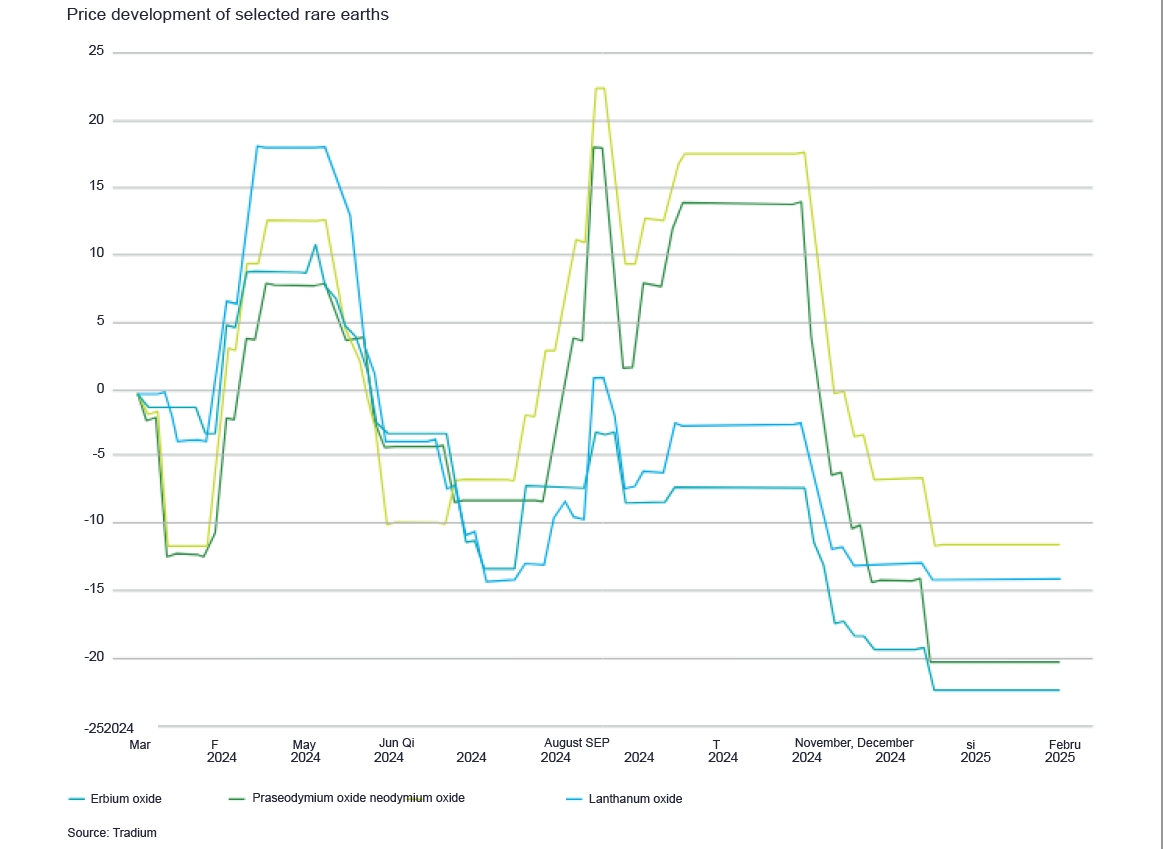

Rare earth prices

Since the start of the pandemic, RE market prices have shown a downward trend, mainly driven by China’s economic slowdown and oversupply. As a result of these factors, producers are finding it more difficult to remain profitable, with two major rare earths suppliers outside of China (Lynas Rare Earths Ltd and MP Materials Corp) looking to improve operational efficiencies to reduce production costs. As a result, China’s economic recovery is seen as an important factor that could reverse the price trend.

In the short term, lower prices may lead to more predictable supply chains and stable costs for consumers; however, future investments will certainly be affected, prices will need to rise to support the development of new projects, and market prices may see further volatility due to new tariffs from the US government.

Environmental concerns are only part of the problem of rare earth mining, which Harvard International Review found creates a huge waste problem, with nearly 2,000 tons of toxic waste (30 pounds of dust, 9,600-12,000 cubic meters of exhaust gases, including hydrogen fluoride and sulfur dioxide, 75 cubic meters of wastewater, and one ton of radioactive residue) for every ton of rare earths mined

Rare earth extraction brings a series of environmental problems that cannot be ignored. The main problem with rare earths as a sustainable solution is that it is difficult for the mining process not to cause environmental damage. One extraction process involves removing the topsoil and creating a leaching pond in it that allows chemicals to separate the rare earths from the ore. Another method is to drill into the ground, pump the chemicals into the ground, and pump the resulting mixture into the leaching tank for separation. Both processes can lead to land, water and air pollution, the spread of toxic waste,

At China’s Baiyun Obo mine, the world’s largest mine, a tailings pond containing 70,000 tonnes of radioactive thorium has begun to seep into groundwater, which could eventually affect the Yellow River, an important source of water. There are many other mines that are unsafe and can have catastrophic environmental impacts if not properly monitored and protected.

This is where governments and international agencies should take positive action to invest more in cleaner refining methods and alternative technologies that rely on less renewable energy

How can rare earths more sustainably support the energy transition?

First, it is important to take the time to assess RE opportunities, ensure that social and environmental safeguards are taken into account, and that government and international policies are complied with. Advances in technology have pushed the extraction process to be more sustainable, with alternative methods including;

Biometallurgy in which naturally occurring organic acids are used to extract rare earth elements. These bacterial acids are less efficient than hydrochloric acid and affect the commercialization of extraction.

Alternative materials are an alternative in which companies invest in R&D and adapt product designs to reduce or eliminate rare earth elements. Alternative technologies previously discussed, showing that manufacturers such as Tesla, Renault, and BMW are investing in alternative materials, but this may result in lower battery power, although cars driven primarily in cities may not need as long battery life. As continued technological advancements in the field, including magnetic alternatives, reliance on rare earth elements has driven R&D towards new avenues that could

Electric currents have been used to extract heavy rare earth elements such as dysprosium and terbium from ores. This reduces the amount of chemicals used, with less pollution but higher energy consumption.

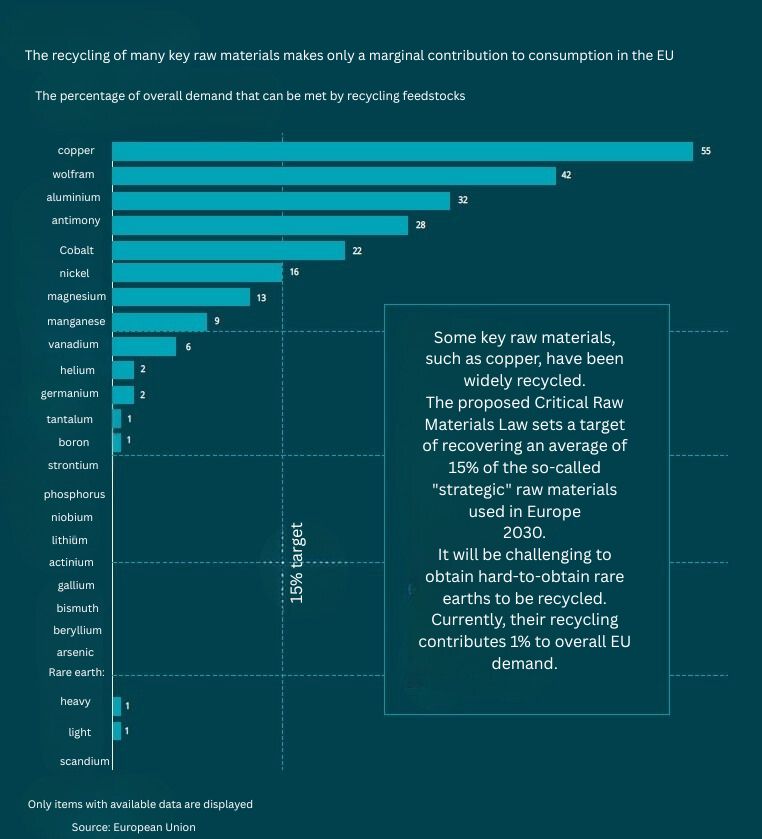

What about recycling rare earths?.

After 2030, the number of EV batteries that are about to become obsolete will surge as demand rises, and the development of recycling can ease supply needs while providing security for countries that are more reliant on clean energy or have fewer reserves.

In the Middle East, Saudi Arabia has rich mineral and metal reserves. The Arabian shield on the Red Sea coast contains valuable medium and heavy rare earths such as tantalum. Saudi Arabia has a quarter of the world’s reserves, which are used for electronics, medical devices, and chemical equipment. In addition, Saudi Arabia has hot tantalum deposits used in energy storage technologies such as batteries, aerospace and steel production.

The problem is that rare earth elements, such as in smartphones, are often mixed with other metals, making them difficult to separate. Traditional recycling methods require the use of hazardous chemicals (such as hydrochloric acid) and consume a lot of heat (and therefore energy). The environmental impact of the process and the cost of recycling may affect the viability of recycling as a solution.

As part of Saudi Arabia’s Vision 2030, mineral resources have been identified as a key market with the aim of diversifying from oil and gas to more than triple the sector’s GDP contribution. The ongoing clean energy transition and the increase in the number of electric vehicles will undoubtedly affect global oil demand. As a result, Saudi Arabia and the UAE are focusing on building a model that is not dependent on fossil fuels, and by increasing investment in the supply chain of mineral resources, Saudi Arabia has entered into a joint venture with Japan to explore development projects. This potential new supply option is expected to bring greater stability to the market

Research into the recovery of rare earths from electric vehicle drive units has determined that the cost of recovering rare earths will be twice as high as those mined from China. If the market price changes, then the viability of recycling may change, however, due to China’s competitiveness and relatively low production costs, there is limited investment in developing this technology, which means that capital can be better used elsewhere.

Given the water-intensive processes required in desert areas, such mining plans may not be feasible without taking into account the use of expensive desalinated water, high energy costs, and environmental risks to aquifers, which may result in contamination of aquifers.

If there are no alternatives to recycled energy (REs), only global regulations that seek to balance commercial incentives with environmental responsibilities may be the driving force behind increased recycling rates.

Recommend

The supply of rare earths presents new and unique challenges that require coordinated efforts at the research, policy and industry levels to ensure a stable and sustainable supply of these vital resources. This will be achieved by:

Conclusion

The environmental challenges posed by the rare earth supply chain do not diminish the significant climate benefits of clean energy. The expected increase in demand raises concerns about the availability and reliability of supply, as well as concerns about geopolitical autonomy and economic competitiveness. If investment opportunities are delayed, this can lead to price volatility that could delay the clean energy transition. Given the urgent need to reduce emissions, these are risks that need to be managed in order to achieve a low-carbon economy.