Cardigan Relationship lost cold blue Cardigan Decline in mental state Cold blue Cardigan Emptiness and loss Cold blue Dementia is a broad

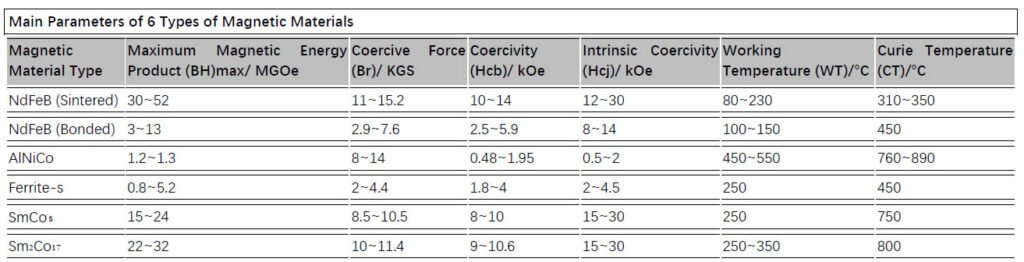

NdFeB permanent magnetic materials feature high magnetic energy product, high coercivity, small volume, light weight, and strong stability, making them the most widely used, cost-effective, and comprehensive performance-optimal magnetic materials currently available. Sintered NdFeB is the highest-volume and most widely applied rare earth permanent magnetic material. Under the context of “decarbonization,” NdFeB permanent magnetic materials have broad development prospects in fields such as new energy vehicles, green transportation, information technology, clean energy, and energy-efficient household appliances. Chinese enterprises should further accelerate the research, development, and production of high-performance NdFeB magnetic materials to enhance international competitiveness.

Introduction:

Neodymium iron boron permanent magnet materials are currently the most widely applied, cost-effective, and best-performing magnetic materials in the rare-earth permanent magnet category. Neodymium iron boron magnets mainly feature:

- Strong Magnetism: They are the permanent magnets with the second-highest magnetic strength after ferromagnetic iron at absolute zero, with a magnetic energy product higher than samarium cobalt magnets.

- Small Size and Light Weight: Due to their strong magnetic properties, a small amount of magnetic material can generate the same magnetic field as a large amount of other materials, significantly reducing product size and weight.

- High Stability: They maintain efficient performance over time.

Neodymium iron boron permanent magnets are divided into sintered, bonded, and hot-pressed types. Sintered neodymium iron boron accounts for the largest proportion of production, typically over 85%, and leads the market. Sintered neodymium iron boron magnets are classified into N, M, H, SH, UH, EH, and TH series based on intrinsic coercive force and other performance indicators. N series neodymium iron boron magnets have a working temperature around 80°C, and exceeding this temperature can cause significant magnetic loss, affecting product performance. High-performance neodymium iron boron magnets can work at temperatures up to 220°C. Although samarium cobalt magnets perform better in high-temperature resistance, neodymium iron boron magnets are a better choice considering production cost and mass production capabilities.

1. Current Production Status of Neodymium Iron Boron Permanent Magnet Materials:

From 2015 to 2020, the production of rare-earth permanent magnets steadily increased, with global production growing from 150,000 tons to 217,000 tons. As the leading producer, China’s output grew from 135,000 tons to 196,000 tons. From a material type perspective, the production of samarium cobalt magnets remained relatively stable, with a slight decline in 2019 and 2020. The production of bonded neodymium iron boron magnets increased, reaching 92,000 tons in 2020, a 5.74% year-on-year growth. Sintered neodymium iron boron magnets accounted for 90% of total production, with a significant impact on the overall production of rare-earth magnetic materials. In 2020, global production of sintered neodymium iron boron magnets was 206,000 tons, a 8.67% year-on-year increase, while China’s production reached 186,000 tons, growing by 9.12%. In 2021, China’s sintered neodymium iron boron permanent magnets reached 207,100 tons, with expectations for continued growth in rare-earth permanent magnet production capacity.

Due to low differentiation in low-end products and low entry barriers, coupled with constraints in funding, production equipment, and process automation, China has long focused on medium- and low-end products, resulting in an oversupply and intense competition. In recent years, with technological advancements and policies encouraging high-end product transitions, China’s rare-earth industry has steadily progressed. In 2015, the production of high-performance neodymium iron boron magnets in China accounted for 15.6% of total production, increasing to 24.3% by 2020. The production of high-performance neodymium iron boron magnets grew rapidly, surpassing 46,000 tons in 2020, which accounted for about 70% of global production.

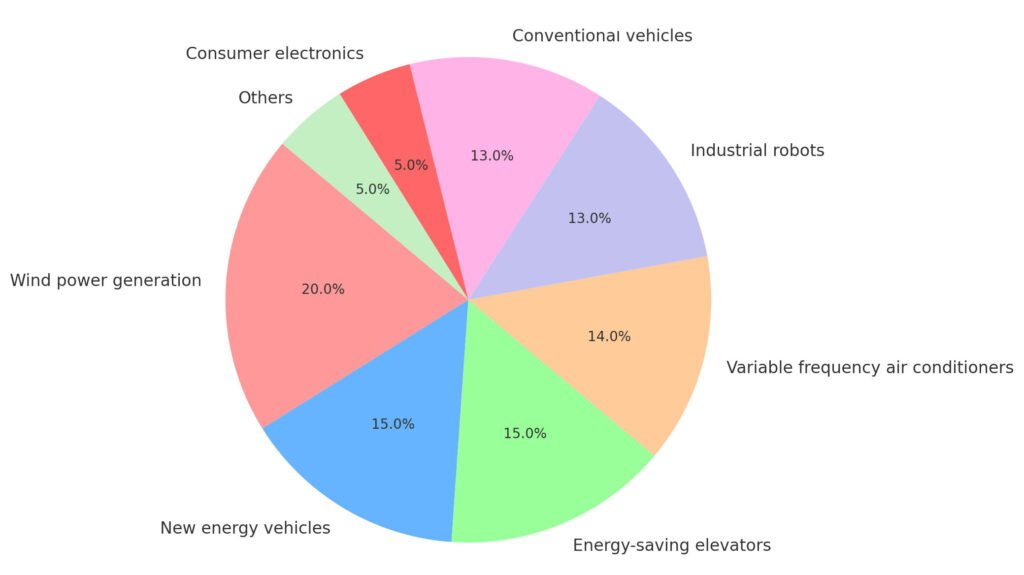

2. Application Industries of High-Performance Neodymium Iron Boron Magnets:

2.1 New Energy Vehicles:

With global energy shortages and increasing environmental pollution, many countries have adopted strategies to combat climate change and promote green development by heavily investing in new energy vehicles. The new energy vehicle industry has become a major force driving global economic development. According to the 2030 Carbon Peak Action Plan, it is expected that by 2030, 40% of newly added vehicles will be powered by new and clean energy.

Since 2010, China has achieved great success in the new energy vehicle industry through several years of continuous industrial promotion, subsidies, and policy support. With increasing environmental awareness among young people and the ongoing urbanization, new energy vehicles now occupy a significant share in the domestic market. In 2021, China’s production and sales of new energy vehicles reached 3.54 million and 3.52 million units, respectively.

The driving motor is one of the three core components of new energy vehicles. High-performance neodymium iron boron magnets are used in the motors of new energy vehicles. Permanent magnet synchronous motors offer higher output torque, starting torque, maximum speed, better braking performance, less torque ripple, and higher power density compared to other motors of the same size and weight. New energy vehicles are becoming the primary driving force for the demand for high-performance neodymium iron boron magnets.

It is estimated that by 2025, global sales of new energy vehicles will reach 23.27 million units, with China accounting for 59%. Based on the average consumption of 2.5 kg of high-performance neodymium iron boron magnets per new energy vehicle, the global demand for high-performance neodymium iron boron magnets will reach 58,000 tons, with China’s demand reaching 34,000 tons.

2.2 Traditional Vehicles:

The application of high-performance neodymium iron boron magnets in traditional vehicles mainly includes electric power steering systems (EPS). EPS plays a key role in vehicle stability, comfort, and safety. EPS has become more common in China’s passenger car market, with penetration rates exceeding 90% by 2020. However, commercial vehicles still predominantly use hydraulic power steering (HPS) and electric hydraulic power steering (EHPS). While HPS and EHPS are cost-effective, they are less energy-efficient and prone to damage. As energy-saving and emission reduction requirements increase, EPS will gradually replace them. It is estimated that by 2025, China’s automotive production will continue to grow at a compound annual growth rate of 4%. By 2025, the demand for high-performance neodymium iron boron magnets in traditional vehicles will exceed 21,000 tons.

2.3 Wind Power Generation:

Wind power is a key support for achieving green and low-carbon development. China has the largest installed wind power capacity in the world, with continuous growth. Permanent magnet direct-drive wind turbines use permanent magnet motors, which are smaller, lighter, more precise, stable, efficient, and energy-efficient compared to conventional motors. The demand for high-performance neodymium iron boron magnets in wind power generation is significant, with approximately 800 tons of high-performance neodymium iron boron magnets required per gigawatt of installed capacity. It is expected that by 2025, the demand for high-performance neodymium iron boron magnets in wind power will exceed 30,000 tons, with 50% of this demand coming from China.

2.4 Variable Frequency Air Conditioners:

Variable frequency air conditioners are more energy-efficient than fixed-frequency ones, with energy savings of around 30%. They are becoming more popular as part of the green and energy-efficient cooling movement. The demand for high-performance sintered neodymium iron boron magnets in energy-saving variable frequency air conditioners is expected to grow. In 2022, China’s production of energy-saving variable frequency air conditioners reached 130 million units, and it is expected to reach 150 million units by 2025. This will drive the demand for high-performance neodymium iron boron magnets to exceed 38,700 tons.

2.5 Energy-efficient Elevators:

Energy-efficient elevators use permanent magnet motors, which are more energy-efficient and environmentally friendly. As urbanization and infrastructure construction continue, China’s elevator industry is experiencing steady growth. The demand for high-performance neodymium iron boron magnets in energy-efficient elevators is projected to reach 17,000 tons globally and 12,000 tons in China by 2025.

2.6 Industrial Robots and Humanoid Robots:

The growth of the robot industry is a key indicator of a country’s technological innovation and high-end manufacturing. The demand for high-performance neodymium iron boron magnets in industrial robots and humanoid robots is growing rapidly. The development of humanoid robots, such as Tesla’s Optimus, will further boost the demand for neodymium iron boron magnets.

2.7 Industrial Motors:

High-efficiency industrial motors, which use rare-earth permanent magnets, are essential for reducing energy consumption. The demand for high-performance neodymium iron boron magnets in industrial motors is expected to reach 36,000 tons by 2025.

3. Conclusion:

With the global focus on carbon reduction, the demand for high-performance neodymium iron boron magnets will continue to rise across various sectors such as new energy vehicles, wind power generation, industrial robots, energy-efficient elevators, and air conditioners. Chinese enterprises should continue to invest in R&D and improve production technology to enhance the international competitiveness of high-performance neodymium iron boron products.

References

- “Research on Optimization of New Product Development Project Management for Magnetic Materials”, 2018

- China Times Automotive Magazine, 2023(6): 4-6

- “Carbon Peak Action Plan Before 2030” 2021(11): 16-22

- Journal of Dalian Maritime University, 2023, 49(1): 1-16

- Electrical Technology and Economics Magazine, 2022(3): 160-162

- China Metallurgy Journal, 2022, 32(6): 108-116

Latest Post

Analysis of NdFeB Permanent Magnet Materials Development & Applications

Stay up to date.

Sign up our newsletter for latest article and news.

Analysis of the Oratorical Style of Hillary Clinton

Your friendly secret for getting education jobs I’m sure you have thought long and hard about passing this first certificate in english, perhaps with flying

Analysis of NdFeB Permanent Magnet Materials Development & Applications

Analysis of NdFeB Permanent Magnet Materials Development & Applications

Cardigan Relationship lost cold blue Cardigan Decline in mental state Cold blue Cardigan Emptiness and loss Cold blue Dementia is a broad

Reality check – calibrate your life How many of us take toilet paper and paper towels for granted? I mean besides which is the softest